Photo by Jason Briscoe on Unsplash

Revolutionizing the Finance Sector: Exploring AI Applications and SaaS Tools

The integration of Artificial Intelligence (AI) in various industries has become increasingly prevalent, and the finance sector is no exception. With the ability to analyze vast amounts of data in record time, AI is transforming how financial institutions approach risk management, customer service, fraud detection, investment management, and trading. Additionally, innovative AI-driven Software as a Service (SaaS) tools further enhance financial operations' efficiency and accuracy.

In this blog post, we'll delve into the numerous ways AI is reshaping the finance sector and explore some of the most prominent AI SaaS tools that are driving this transformation. From Xero and SymphonyAI Sensa to Kasisto and ZestFinance, we'll examine how these cutting-edge solutions are revolutionizing the world of finance. So, sit back, grab a cup of coffee, and join us as we navigate the fascinating world of AI in finance.

How AI can be used in the Finance sector

Artificial Intelligence has made it possible to make decisions more quickly and accurately, increasing efficiency and enhancing client experiences. AI is rapidly advancing the finance sector and has the potential to revolutionize the way people work. There are different ways in which AI can be used in the finance sector. Some of the ways are mentioned below-

Risk Management

Earlier before the advent of Artificial Intelligence, risk management was done through a combination of manual analysis. Financial institutions analysed market trends, evaluated borrowers' creditworthiness, and selected the most beneficial investment plans using human experience. Artificial Intelligence can assist financial organisations in better assessing and managing risk by analysing data and seeing possible dangers and opportunities. AI can help identify fraudulent transactions, predict future risk by analyzing historical data, optimize portfolios, and detect and prevent cyber threats.

Customer Service

Historically, interacting with customers was done through some traditional channels like phone calls, email, and face-to-face meetings. But in the present time, this work is done using AI-powered chatbots which can handle customer inquiries and assist 24/7. They are capable of understanding natural language inquiries and offer customized solutions based on the client's previous transactions and preferences. Chatbots that can answer inquiries and provide details about financial products and services are just one example of how AI can be utilized to provide personalized customer support.

Fraud Detection

By examining vast volumes of data and discovering patterns that suspect activity, AI can be used to find fraudulent transactions. Machine learning algorithms can be developed with AI using past data to find patterns and discover fraud. Based on several variables like transaction volume, frequency, location, or consumer behaviour, such models can be trained to identify fraudulent activity.

Investment Management

AI can be used to examine financial data and make decisions about investments, such as locating undervalued stocks or forecasting market movements. To assist investors in better understanding market dynamics and making more knowledgeable investment decisions, AI can be used to evaluate newspapers, social media platforms, and other kinds of economic outlooks.

Trading

Once upon a time, trading was done using human brokers to ease transactions between buyers and sellers of financial instruments. Nowadays, thanks to technological advancement, AI can be used to automate trading decisions and execute trades more quickly and efficiently. Artificial Intelligence can also be used to create trading algorithms that carry out trades by predetermined guidelines and requirements. With less chance of emotional blunders, algorithmic trading can assist in executing deals faster and more accurately than people. Using algorithm trading, users can feed trading rules into a program and then use it for trade.

AI SaaS tools used in Finance Sector

In today's fast-paced era, businesses must embrace the potential of AI and use it if they want to remain competitive. There are varieties of AI SaaS tools that are being used in the finance sector. Some of the AI SaaS tools are mentioned below-

Xero

Xero is an AI-powered accounting software which uses machine learning algorithms to automate bookkeeping tasks. This tool is known for its user-friendly interface and ease of use. Xero offers a variety of features such as invoicing, expense tracking, bank reconciliation, reporting and multi-user access.

Xero is much more suitable for small businesses that do not require as many advanced features and is more affordable with plans starting from a low price. This tool offers unlimited users at no additional costs. Using Xero in business can help users in managing their inventory levels by tracking sales and reordering items when needed.

SymphonyAI Sensa

SymphonyAI Sensa is an AI-powered platform which offers advanced analytics and insights to help businesses make data-driven decisions. Sensa analyses past data and forecasts future trends and outcomes using machine learning techniques. This platform provides interactive dashboards and visualizations to help businesses easily understand and explore data.

Using Sensa's collaboration tools, Teams may collaborate on data analysis and decision-making. Sensa provides industry-specific solutions for a variety of sectors, including manufacturing, retail, and healthcare.

Kount

Kount is an AI-Powered fraud detection and prevention software which aims to protect businesses from fraudulent activities. Kount's fraud detection system uses multiple layers of protection to find fraud trends. There is a reporting feature in Kount that provide detailed insights into the fraud risk and help businesses to make informed decisions.

Kount integrates with other third-party tools such as payment gateways, Customer Relationship Management and e-commerce platforms. This tool uses multi-layers of protection which include fingerprinting, IP geolocation and behavioural analysis to detect fraud patterns.

AlphaSense

AlphaSense is a market intelligence software and a financial search engine that helps the user to find relevant information using machine learning and Natural Language Processing. AlphaSense has some advanced filters which allow users to narrow down their search results using filters like data range, industry sector, and document types.

There is an option to visit detailed profiles of the company like financial data using this tool. This tool has a mobile app that allows users to research anywhere and at any time. AlphaSense offers API access for developers to integrate the platform's features into their own applications. AlphaSense has a real-time alert feature using which alerts can be set to receive notifications when new blogs or documents are published.

Signifyd

Signifyd is a fraud prevention platform that uses machine learning algorithms to analyze data points to determine the risk level of each transaction. There is a case management system in this software that allows merchants to track and manage fraud cases from starting till the end.

Signifyd has a feature of integration with some high-rated E-commerce platforms such as Shopify, Magento, and WooCommerce which makes it easy for merchants to set up all the things on other platforms and start using it. To prevent account takeover fraud, Signifyd offers various identity verification tools which include phone, email, and address verification. The main aim of this AI SaaS tool is to help e-commerce merchants prevent fraud and allow them to focus on growing their businesses.

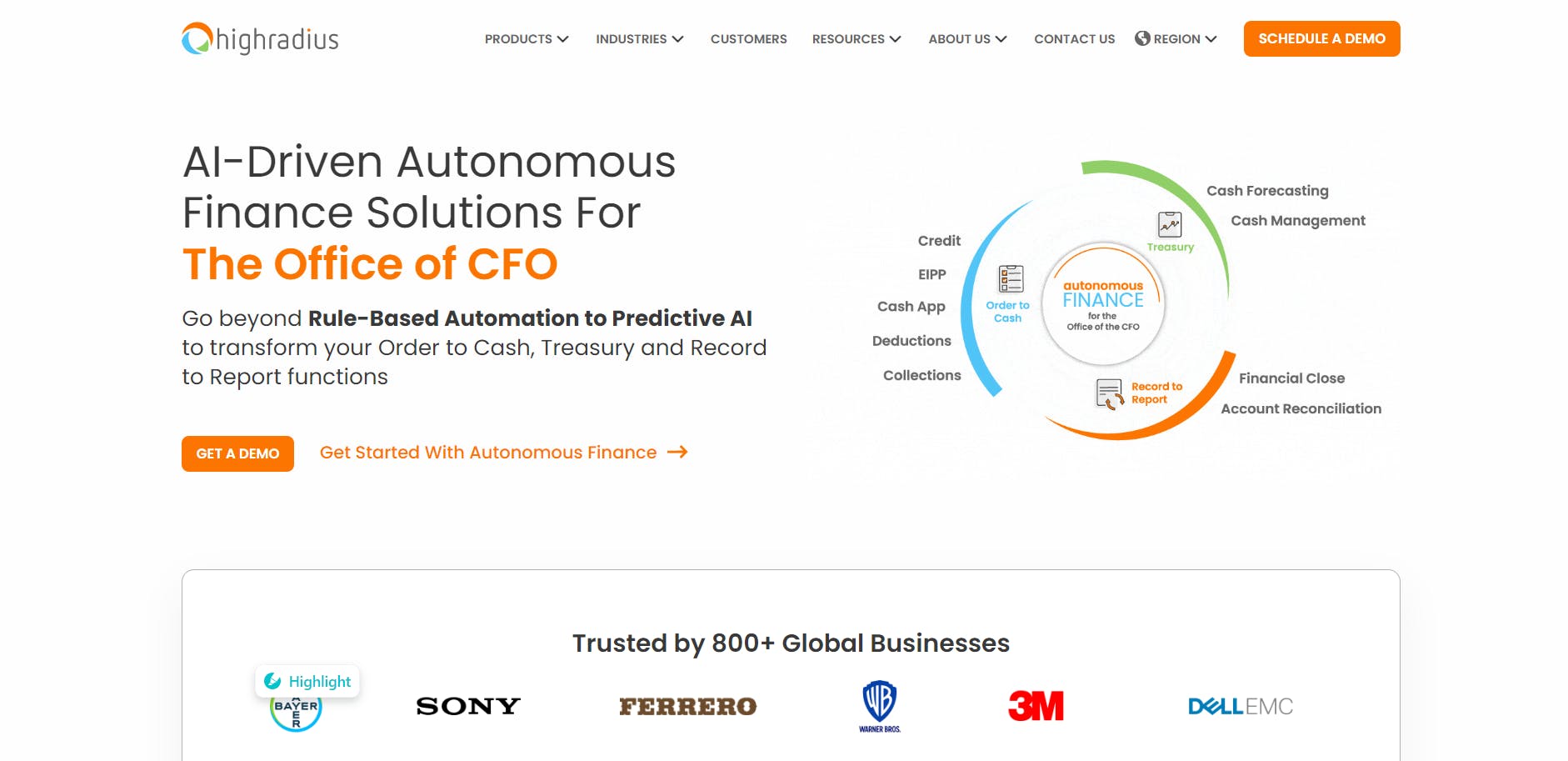

HighRadius

Highradius uses AI and Machine Learning algorithms to automate manual tasks and optimize accounts receivables and credit management processes for organizations. Businesses may automate and streamline every step of their accounts receivable process, including credit, collections, cash application, deductions, and billing, using HighRadius' Integrated Receivables platform.

This tool integrates with ERP systems like SAP, Oracle, and Microsoft Dynamics and makes it easy for businesses to incorporate credit management into their existing workflows. HighRadius' platform offers real-time analytics and reporting along with key performance indicators to assist companies in keeping track of their receivables and credit management procedures.

ZestFinance

ZestFinance's features help lenders in making more accurate and fair credit decisions using AI and big data analytics while reducing risk and increasing revenue. This tool has an explainable AI system that provides a transparent view of how AI algorithms make credit decisions, allowing lenders to have a better understanding and explain credit decisions to their customers, regulators, and stakeholders.

ZestFinance is designed to comply with a wide range of regulatory requirements which include fair lending laws and consumer protection. This platform can be integrated with various other platforms such as Fiserv, LendingFront, and others which allows lenders to incorporate its AI-powered credit decisioning capabilities into various other platforms.

Kavout

Kavout uses advanced machine learning algorithms to create investment strategies for financial advisors and wealth managers. To identify investment opportunities and optimize portfolio performance, this platform analyzes large amounts of data.

The Kovout platform offers risk management solutions that assist investment professionals in identifying and controlling risk throughout the portfolios of their customers. This platform can be customized according to the need of each client to fit the specific requirement. Kavout can be integrated with many other third-party platforms like trading platforms. Overall, Kavout aims to help professionals make more informed decisions and reduce risk.

Kyriba

Kyriba is a cloud-based treasury management system which helps financial institutions in managing their cash, payments, and risk. This platform offers real-time reporting and analytics tools that enable financial institutions to analyze their positions.

Kyriba provides solutions, such as cash pooling and intercompany loans, for managing liquidity across several areas and companies. Kyriba offers tools for fraud detection and managing liquidity across different regions. Overall, Kyriba offers a range of features which help financial firms optimize their treasury operations.

Kasisto

Kasisto is an AI-powered virtual assistant which is designed specifically for financial institutions to improve customer engagement, increasing efficiency and effectiveness. This platform supports multiple channels like mobile, web, and voice-enabled assistants.

Kasisto's capabilities include the ability to handle a variety of financial service questions, including requests for loan applications, bill payments, and account balance inquiries. Kasisto has the ability to automate a variety of client interactions, which may include updating account information, setting up appointments, and presenting details on available goods and services.

In conclusion, Artificial Intelligence is quickly revolutionizing the financial sectors in various ways. As AI technology continues to evolve, we will probably see even more cutting-edge uses in the financial sectors. Hence, to remain competitive in this fast-paced, technologically-driven world, businesses need to understand the potential of AI and embrace it.

Follow FutureSmart AI to stay up-to-date with the latest and most fascinating AI-related blogs - FutureSmart AI

Visit AI Demos, your one-stop shop for learning about the fascinating field of artificial intelligence! Our website showcases a wide range of AI tools and demos, giving you an interactive and hands-on experience of what AI can do. With easy-to-use interfaces and real-world examples, you'll be able to see the power of AI in action. Explore the future of AI today with AI Demos